Types of Education Loans in State Bank of India

The State Bank of India education loan is categorized into several schemes that cater to the varied needs of students. State Bank of India education loan schemes are as follows -

- SBI Student Loan Scheme

- SBI Scholar Loan Scheme

- SBI Skill Loan Scheme

- SBI Global Ed- Vantage

- SBI Takeover of Education Loan Scheme

- SBI Shaurya Education Loan

For students who are looking for an abroad education loan SBI offers the SBI Global Ed- Vantage scheme wherein students can avail up to INR 1.5 cr of financing for their education in India or abroad.

Application Process of SBI Abroad Education Loan for Abroad Without Collateral

The SBI student loan without collateral application process is quite simple.

Step 1 - Prospective students need to visit the SBI website navigate to the education loan section and click on ‘Apply now’.

Step 2 - Next, fill out the SBI education loan application form.

Step 3 - Upload required documents including proof of admission to an eligible course and institution, alongside other necessary documents such as academic records and proof of identity.

Step 4 - Submit the form and SBI will coordinate with you once they verify your application.

The SBI collateral free education loan is an excellent financial tool for students aspiring to study overseas. With an SBI education loan for abroad without security, competitive interest rates, and comprehensive coverage of educational expenses, this loan makes the dream of studying abroad achievable for many students.

The Global Ed-Vantage education loan from SBI

The Global Ed-Vantage education loan scheme offers secured education loans to Indian students who want to pursue higher education abroad. Under this scheme, students can borrow up to INR 1.5 Cr to fund their education abroad. To secure SBI education loan for abroad students have to pledge collateral that holds at least 90% value of the total loan amount.

Established in 1955, the State Bank of India (SBI) is India's beacon of trust and reliability in the banking sector, offering a comprehensive SBI abroad education loan to empower students. As India's largest public sector bank, SBI extends its support to students through its specialized SBI education loan for abroad studies, enabling them to pursue their academic dreams in foreign lands.

For example - If a student wants to secure a loan amount of INR 50 Lakh, then his collateral value should be atleast INR 45 Lakh.

SBI's Global Ed-Vantage scheme is a tailored SBI student loan for study abroad, designed to support Indian students aspiring to study overseas. This abroad SBI student loan facilitates higher education across various countries, offering loans up to INR 1.5 Cr. It's a perfect choice for students seeking a SBI study loan for abroad, ensuring their educational journey is well-funded. The education loan SBI provides is more than just financial assistance; it's a gateway to achieving your education dreams without the burden of financial constraints.

Please note, under this scheme, collateral security offered by a third party (other than parents) can also be accepted.

Overview of the Global Ed-Vantage Education Loan from SBI

For students plotting their academic future abroad, understanding the nuances of the SBI education loan for abroad studies is crucial. From processing fees to margin money, each aspect of this SBI abroad education loan is crafted to ease the financial burden, making your study abroad experience seamless.

| Feature | Description |

|---|---|

Loan amount |

INR 7.5 Lakh - INR 1.5 Cr |

11.15% (Floating) |

|

Processing fees |

INR 10,000 + GST (Non-refundable) |

INR 7.5 Lakh-INR 20 Lakh - 15% INR 20 Lakh - 10% |

|

Property evaluation charges |

Approximately INR 7,500 |

Course duration + 6 months |

|

Repayment tenure |

15 years |

*Moratorium period is the time duration during which you are not required to make payments toward your education loan.

*Margin money refers to the amount of money that a borrower is required to contribute towards the loan, while the remaining amount is paid by the lender.

Interest Rate of SBI Student Loan Scheme

Students now have greater access to higher education because to the attractive interest rates that the State Bank of India (SBI) offers on its student loan programs. An SBI education loan has a current interest rate of 11.15% (variable). Furthermore, the following concessions are offered to lower the cost of the loans:

- Female students are eligible for a 0.5% interest rate discount.

- Students who choose to purchase an existing life insurance policy or the SBI Rinn Raksha policy will receive an additional 0.5% discount.

What is Rinn Raksha Insurance?

Rinn Raksha is an insurance scheme offered by the State Bank of India student loan for its education loan borrowers. This insurance scheme protects the borrower's family in the unfortunate event of the borrower's untimely demise during the repayment tenure of the loan.

Under the "Rinn Raksha" scheme, SBI offers two types of insurance coverage options to education loan borrowers: Group Credit Life Insurance (GCLI) and Term Life Insurance (TLI). The GCLI provides coverage against the outstanding loan amount in case of the borrower's demise, while the TLI provides coverage against the total sum assured.

Not only this, students who opt for this insurance are eligible for an additional 0.5% concession on the overall interest rate of their education loan.

When it comes to financing your higher education, State Bank of India student loan offerings are diverse and cater to the unique needs of students. The education loan SBI provides is designed to offer competitive rates and terms that help ease the financial burden of studying abroad. Whether you're seeking a SBI bank student loan, you will find that SBI's commitment to supporting education shines through in their loan products.

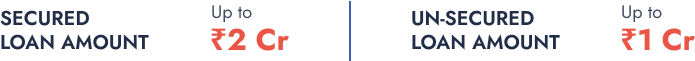

SBI Education Loan Without Collateral

The most attractive feature of the SBI education loan without collateral for abroad is that it does not require any security or collateral for loans up to INR 7.5 Lakh. This is a significant advantage for students who do not have valuable assets to pledge. The SBI unsecured education loan ensures that the lack of collateral does not become a barrier to achieving your academic dreams.

For education loans amounting to more than INR 7.5 Lakh, a collateral is must. However, when applicants opt for an SBI non collateral education loan for abroad, the parents or guardian must co-sign the loan with the student.

As SBI provides education loans without a co applicant, a financial co-applicant is generally not required. Hence, students looking for SBI education loan without co applicant can opt for collateral-based loans where a financial co-applicant is not required.

SBI Education Loan Documents Required

The documents required for an SBI education loan for abroad depend on several factors, primarily your academic and professional history, your co-applicant's financial and credit profile, and the location of the property or asset, which you offer as collateral.

Applicants' Documents Required for Student Loan SBI:

Identity proof: PAN/ Passport/ Driver’s License/ Voter ID card or government-issued identification document.

- Education loan application form.

- Address proof: recent copy of telephone bill/ electricity bill/water bill/ piped gas bill/ driving license/ Aadhaar card.

- Passport

- Past academic record.

- 10th standard mark sheet

- 12th standard mark sheet

- Undergraduate result (semester-wise)

- Entrance exam results (e.g. GMAT, GRE, TOEFL, etc.)

- Proof of admission: admission letter (A conditional admission letter is also applicable).

- Statement of expenses.

- 2 passport-size photographs.

- Loan A/C statement of one year (if applicable)

- Bank account statement of the student (if applicable)

Co-applicant’s Documents Required for Student Loan SBI:

Identity proof: PAN/ Passport/ Driver’s license/ Voter ID card or government-issued identification document.

- Address: recent copy of telephone bill/ electricity bill/water bill/ piped gas bill or copy of passport/ driving license/ Aadhaar card.

- 2 passport-size photographs.

- If any previous loan is from other banks/ lenders, then the loan A/C statement of 1 year.

- Legal documents of the collateral/ property documents.

- Bank account statement of the co-borrower/guarantor, for the last 6 months (in case of takeover of education loan).

Income proof for salaried co-applicant/guarantor:

- Salary slips for the last 3 months.

- Copy of form 16 of the last 2 years or copy.

- Bank account statement for the last 6 months (Salary account).

- Brief statement of assets & liabilities of parent/ guardian/ other co-borrower.

Income proof for self-employed co-applicant/ guarantor:

- Business address proof.

- Last 2 years IT returns ( If IT Payee).

- TDS certificate (Form 16A, if applicable).

- Certificate of qualification (for C.A./ doctor and other professionals).

- Brief statement of assets & liabilities of parent/ guardian/ other co-borrower

- Bank account statement for the last 6 months.

Documents Required for Student Loan SBI Against property

The list of documents required for collateral study loan SBI depends on several factors, primarily: property type, purchase history, and location. Broadly, the following documents are required:

Common documents:

- Registered sale deed.

- Approved plan or map of the constructed property.

- Chain documents, evidencing the ownership history of the property for the last 30 years.

- Latest property tax receipt.

- Occupancy proof.

Additional documents if you’re applying for a study loan SBI with a property in the following cities:

Mumbai or Pune:

- NA order

- Urban land ceiling order

- NOC from a builder or society

- Share certificate

- Letter of allotment

- Conveyance deed of society

- If CIDCO / MHADA property: NOC and transfer letter

Hyderabad:

- Urban land ceiling certificate

- NA certificate, if not included in the sale deed

- 7/12 extract, if not included in the sale deed

- Encumbrance certificate

Bengaluru:

- RTC (Record of tenancy certificate)

- Conversion order (from agriculture to residential)

- Khata certificate ( A or B )

- Property tax receipt

- Encumbrance certificate

How to Contact SBI for an Education Loan

To contact SBI for an abroad education loan, you can choose the following methods -

- Email - You can get in touch with SBI over email. Send an email to SBI’s customer support team at gm.customer@sbi.co.in. Mention relevant details about your profile, and they will provide a response tailored to your needs.

- Online application form - You can complete an online application form at the SBI website (https://sbi.co.in/web/personal-banking/home). Later, SBI will evaluate your profile and proceed with the necessary steps.

- Branch visits - For a more personal approach, you have the option to visit the nearest SBI branch in your city or locality. The State Bank of India operates a vast network of 28,802 branches across all 36 states and union territories in India.

Opting for an SBI student loan means you're backed by one of India's most trusted financial institutions. The SBI study loan is not just a financial transaction; it's a stepping stone to your future, offering flexible repayment options and comprehensive coverage of education-related expenses.

If you prefer a more convenient approach and want to avoid the hassle of physically visiting branches and dealing with complex application forms, you can apply for an education loan through Shikshavahini, an education financing platform that specializes in assisting students in securing funds for their higher education abroad. Our dedicated counselors will carefully evaluate your profile and recommend the most suitable lenders for your specific loan requirements.

How to Apply State Bank of India Education Loan Online

To secure an education loan in SBI, you can apply online at the SBI website. Once you fill out the application form online, you will have to visit the nearest SBI branch with all your documents. To avoid these complex steps, you can simply apply for your education loan via Shikshavahini.

Understanding the different aspects of an SBI student loan can help you make the best choice for your educational journey. With options ranging from SBI study loan to more specific SBI student education loan plans, SBI caters to a wide array of academic disciplines and study destinations.

Leverage Shikshaahini's expertise to navigate the SBI education loan for abroad studies effortlessly. With their guidance, applying for a SBI student loan for study abroad becomes a seamless journey, ensuring your dreams are just a loan away.

Shikshaahini is an online platform that helps students in India to finance their education abroad. With us, you can get your education loan sanctioned in four simple steps:

Apply online Free doorstep document collection Processing & approval Loan sanction & disbursal

Benefits of SBI Education Loan for Overseas Studies

Getting your SBI education loan through Shikshavahini:

- Guaranteed best loan: Shikshavahini is committed to providing you with the most competitive education loan available in the market. We strive to bring you the best possible deal. If you happen to come across a better offer, we will cover the difference in interest rates for the entire duration of your education loan.

- Low turnaround time: Shikshavahini officials coordinate with various departments within SBI to secure a loan approval in just 15-20 days. This is why 1000s of students trust us with their loan requests every year. If a student applies directly to the bank, the usual SBI loan processing time is around 30-45 days.

- Doorstep service: SBI education loan for abroad, Shikshavahini provides doorstep pickup service of documents in Delhi, Mumbai, Pune, Hyderabad, Bengaluru, Chennai & Kolkata.

- 100% free of cost services: Shikshavahini's services for applicants are absolutely free. We do not charge any kind of processing fees or commissions from the applicants at all.

- Higher chances of approval: In case of any missing documents, property issues, or other problems, we approach SBI officials promptly to find solutions. This ensures speedy resolution and significantly increases your odds of approval. In case of any bottlenecks, Shikshavahini will always be by your side!

The Shikshavahini Effect on SBI

| Feature | With Shikshavahini | Without Shikshavahini |

|---|---|---|

Document pickup service from home |

Yes (7 RO cities) |

No |

Personalized document checklist according to profile & area |

Yes |

No |

Branch Visits |

1-2 |

7-8 |

Pre-visa disbursements |

Easy |

Difficult |