Overview

As one of the country's leading NBFC, HDFC Credila has helped thousands of students achieve their academic dreams.

HDFC Credila Financial Services, India's pioneering education loan provider, offers tailored education loan solutions to students aspiring to study abroad. Covering over 1000 universities across 35 countries, HDFC Credila stands out by providing customized loan options based on the applicant's course and country preferences. The HDFC Credila student loan personalized approach ensures that each student's unique financial needs are met, making HDFC Credila the preferred choice for education financing among study abroad aspirants.

HDFC Credila Education Loan Without Collateral

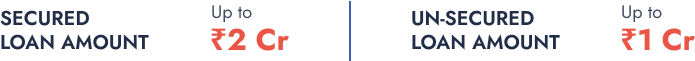

Getting an HDFC Credila loan without collateral is a viable option for students who aspire to study abroad but may not have the necessary assets to pledge as security. HDFC Credila offers customized education loan solutions, allowing students to finance their overseas education without the need for collateral under certain conditions. This facilitates greater access to quality education for a broader range of students, ensuring that financial constraints do not hinder academic aspirations. The HDFC Credila student loan without collateral interest rate is competitive compared to other lenders. The HDFC Credila student loan without collateral empowers students to pursue their dreams without the added stress of securing collateral.

Overview of HDFC Credila Loan Without Collateral

| Feature | Description |

|---|---|

Loan amount |

Up to INR 1.5 Cr (Secured loan) |

10.50% - 12.25% |

|

Processing fees |

0.75%-1.25% of the sanctioned amount |

Processing time |

7-10 days |

nil |

|

Course duration + 1-year |

|

Repayment tenure |

15 years |

*Moratorium period is the time duration during which you are not required to make payments toward your education loan.

*Margin money refers to the amount of money that a borrower is required to contribute towards the loan, while the remaining amount is paid by the lender.

Income Tax Under Section 80e Benefits by HDFC Credila

HDFC Credila is the only NBFC in India that offers tax benefits under Section 80E on HDFC Credila non collateral education loan. Section 80E of the Income Tax Act allows individuals to claim a deduction for the interest paid on an education loan for a maximum period of eight years, starting from the year in which the repayment of the loan begins. The deduction can be claimed for the interest paid on the loan. It is important to note that the tax benefit under Section 80E is only available for the interest paid on the education loan and not for the principal amount.

Eligibility Criteria HDFC Credila Unsecured Education Loan

Understanding the HDFC Credila education loan requirements is crucial for students and co-applicants before embarking on the application process. By familiarizing yourself with the HDFC Credila education loan eligibility criteria, you can streamline the application process, ensuring a smoother and more efficient journey toward securing a Credila education loan. Below are the HDFC Credila collateral free loan eligibility criteria -

- Age: To secure an HDFC study abroad loan the applicant must be an Indian citizen and at least 18 years of age or older at the time of application. The student should have secured admission to a recognized university.

- Academic performance: To get an HDFC Credila without collateral loan applicant should have a strong academic record to get an HDFC study abroad loan. The applicant must meet the minimum academic criteria set by the lending institution and fulfill prerequisite tests such as GRE, IELTS, or TOEFL.

- Co-applicant: To be eligible for the HDFC study abroad loan, the borrower is required to have a co-applicant who can be their mother father, sister, brother, spouse, relative from their paternal or maternal side, or a legal guardian. The co-applicant should have a steady source of income and a positive credit history.

- Course and country of study: The scheme covers a wide range of courses including regular graduate degrees, post-graduate degrees, diploma, certificate, and doctorate courses offered by foreign institutes and universities in countries such as the USA, UK, Canada, Australia, New Zealand, France, Germany, and Ireland, among others.

HDFC Credila Education Loan for US

| Feature | GRE > = 310 | GRE 300 = < 310 | GRE 285 = < 299 |

|---|---|---|---|

Rate of interest |

11.25 - 11.75% |

11.75% - 12.5% |

12.5 - 13% |

Loan amount |

Up to INR 65 Lakh |

Up to INR 50 Lakh |

Up to INR 40 Lakh |

INR 30K |

INR 35K |

INR 35K |

|

Monthly installments during the course |

Partial simple interest |

Partial simple interest |

Simple interest |

Processing fee |

0.5 - 1% |

0.7 - 1% |

1% |

HDFC Credila Education Loans for Other Countries

| Feature | Australia / New Zealand | Canada | UK | Germany/ Ireland/France/ Italy |

|---|---|---|---|---|

Rate of interest |

12 - 13% |

11.75 - 12.5% |

12 - 13% |

12 - 12.75% |

Loan amount |

INR 25 Lakh |

INR 40 Lakh |

INR 40 Lakh |

INR 25 Lakh |

Co-applicant minimum income |

INR 60K |

INR 35K |

INR 40K |

INR 40K |

Monthly installments during the course |

Simple interest / EMI |

Partial simple interest |

Simple interest / Partial simple interest |

Simple interest / Partial interest |

Processing fee |

1% |

0.75 - 1% |

1 - 2% |

1 - 1.5% |

Documents Required for HDFC Credila Education Loan

Shikshavahini provides a customized documents list for HDFC Credila non collateral loan, which depends on your profile, your co-applicant profile, and any property/asset, you may offer as collateral.

Applicants' documents

Identity proof: PAN/ Passport/ Driver’s License/ Voter ID card or government-issued identification document.

- Education loan application form.

- Address proof: recent copy of telephone bill/ electricity bill/water bill/ piped gas bill/ driving license/ Aadhaar card.

- Passport

- Past academic record.

- 10th standard mark sheet

- 12th standard mark sheet

- Undergraduate result (semester-wise)

- Entrance exam results (e.g. GMAT, GRE, TOEFL, etc.)

- Proof of admission: admission letter (A conditional admission letter is also applicable).

- Statement of expenses.

Co-applicants documents

- Identity proof: PAN/ Passport/ Driver’s license/ Voter ID card or government-issued identification document.

- Address: recent copy of telephone bill/ electricity bill/water bill/ piped gas bill or copy of driving license/ Aadhaar card.

- Bank account statement of the co-borrower/guarantor, for the last 6 months (in case of takeover of education loan).

Income proof for salaried co-applicant/guarantor

- Salary slips for the last 3 months.

- Copy of Form 16 of the last 2 years or copy.

- Bank account statement for the last 6 months (Salary account).

- A brief statement of assets & liabilities of parent/ guardian/ other co-borrower.

Income proof for self-employed co-applicant/ guarantor

- Business address proof.

- Last 2 years IT returns ( If IT Payee).

- TDS certificate (Form 16A, if applicable).

- Certificate of qualification (for C.A./ Doctor and other professionals).

- A brief statement of assets & liabilities of parent/ guardian/ other co-borrower

- Bank account statement for the last 6 months.

HDFC Bank Education Loan EMI Calculator

How to Apply for HDFC Credila Education Loans via Shikshavahini?

If you are looking to secure an abroad education loan from HDFC Credila, you can apply online at their website. However, for a hassle-free application process, you can choose to apply for your education loan through Shikshavahini.

Shikshavahini is an online platform designed to assist Indian students in financing their education abroad. To start your process with us all you need to do is check your loan eligibility and leave the rest to us!

Apply online Online document submission Processing & approval Loan sanction & disbursal

How to Contact HDFC Credila for Education Loans?

To contact HDFC Credila for abroad education loan-related inquiries you can use the following methods:

- Email: You can send an email to HDFC Credila's customer support team at support@hdfccredila.com. Provide detailed information about your profile and they will respond to you accordingly.

- Online application form: Visit the HDFC Credila website (https://www.hdfccredila.com) and navigate to the "Contact Us" section. You can fill out the online application form and they will evaluate your profile and further the process.

- Branch visit: You can physically visit the nearest HDFC Credila branch in your city or locality. Their staff will assist you with information about education loans, the application process, required documents, and other relevant details. HDFC Credila’s head office is located in Mumbai, other than that there are 11 offices located across various cities in India, including Pune, Bangalore, Delhi, Gurgaon, Ahmadabad, Chennai, Hyderabad, Kolkata, and Nasik.

If you want to secure an HDFC education loan without collateral from HDFC Credila but want to skip the struggle of visiting branches physically and dealing with complex application forms, then you can apply for an education loan via Shikshavahini, which provides a convenient solution. As an education financing platform, Shikshavahini specializes in assisting students in obtaining funds for their higher education abroad. Once you are eligible for an education loan via Shikshavahini, our dedicated counselors thoroughly evaluate your profile and recommend the most suitable lenders for your specific loan requirements. Moreover, our counselors will assist you throughout your loan process and are readily available to address any concerns or challenges that may arise along the way. To check your eligibility click here.

Benefits of HDFC Credila Education Loan

Getting your HDFC Credila education loan through Shikshavahini

Guaranteed best product: At Shikshavahini, we are committed to providing you with the most competitive education loan available in the market. We strive to bring you the best deal possible. If you happen to come across a better offer, we guarantee to cover the difference in interest rates for the ENTIRE duration of your education loan.

Low turnaround time: Team Shikshavahini effectively coordinates with various departments within HDFC Credila to secure a loan approval in just 5-7 days. As a result, thousands of students trust us with their education loans every year. If a student were to apply for a loan directly with the NBFC, the loan processing time would typically take around 12 - 15 days.

100% free of cost services: Shikshavahini's services for candidates are completely free of cost. We do not levy any processing fees or commissions from the applicants whatsoever.

Higher chances of approval: In case of any obstacles regarding documentation or application, Shikshavahini intervenes and resolves the problem by coordinating with the officials at HDFC Credila.

Hassle-free process: If you directly apply for an education loan you might face several challenges but with Shikshavahini all you need to do is check your eligibility and if you are eligible then all you need to do is relax until disbursement, because you will be assigned a dedicated education loan counselor.

The Shikshavahini Effect in HDFC Credila Education Loan

| Feature | With Shikshavahini | Without Shikshavahini |

|---|---|---|

Personalized document checklist according to profile & area |

Yes |

No |

Branch visits |

1-2 |

7-8 |

Pre-visa disbursements |

Easy |

Difficult |