🎓 ICICI Bank Education Loans: A Complete Guide for Students Study in India & Abroad

Are you aspiring to study in a premier institution in India or abroad? ICICI Bank's education loans are designed to help you finance your dream without financial barriers. With flexible repayment, high loan amounts, and digital processing, ICICI Bank ensures a smooth academic journey.

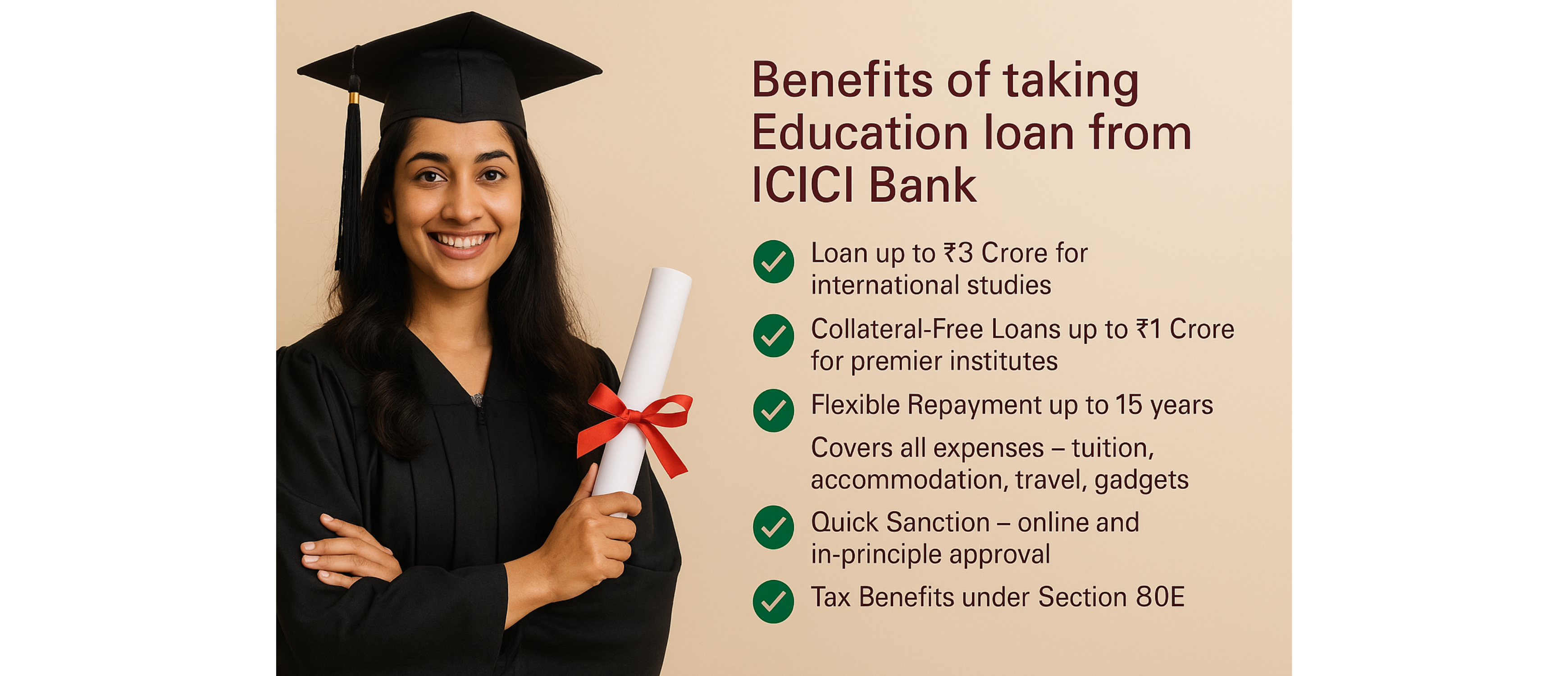

🌟 Why Choose ICICI Bank for Your Education Loan?

✅ Loan up to ₹3 Crore for international studies

✅Collateral-Free Loans up to ₹1 Crore for premier institutes

✅Flexible Repayment up to 15 years

✅Covers all expenses – tuition, accommodation, travel, gadgets

✅Quick Sanction – online and in-principle approval

✅Tax Benefits under Section 80E

✅Digital Application and real-time tracking

🧾 Types of Education Loans Offered by ICICI Bank

ICICI Bank offers three main categories of education loans, based on location and eligibility.

🎓 1. Domestic Education Loan

Purpose:

To finance higher education (graduate/postgraduate/professional) within India.

Key Features:

Ideal For:

Students studying in recognized Indian colleges including IITs, NITs, AIIMS, IIMs, or UGC/AICTE-approved institutions.

🌍 2. Education Loan for Studying Abroad

Purpose:

To support students pursuing higher education overseas in countries like USA, UK, Canada, Germany, Australia, and more.

Key Features:

Ideal For:

Students pursuing UG or PG degrees abroad at universities with good academic standing (usually as per QS or Times Higher Education rankings).

⚡ 3. Pre-Approved Instant Education Loans

Purpose:

To offer a quick-sanction, paperless loan option to existing ICICI Bank customers.

Key Features:

Ideal For:

ICICI Bank customers (salaried or self-employed) with a strong credit profile looking for quick education financing.

🧩 Comparison Overview

| Loan Type | Max Loan Amt (₹) | Collateral | Tenure | Best For |

|---|---|---|---|---|

| Domestic Education | Up to ₹1 Cr | Optional (premier) | Up to 14 Y | Indian UG/PG students |

| Study Abroad | Up to ₹3 Cr | Optional up to ₹1Cr | Up to 15 Y | International UG/PG applicants |

| Pre-Approved Instant | ₹50L–₹1 Cr | Not required | Up to 15 Y | Existing ICICI customers needing fast approval |

📝 ICICI Education Loan Application Process

🌍 Countries Covered for International Loans

ICICI Bank funds study in countries including:

💡 Additional Benefits

✔️ Tax Deduction on interest under Section 80E

✔️No Prepayment Charges

✔️Online tracking of loan status

✔️Dedicated helpline for student services

✔️Forex & overseas banking support

❓ Frequently Asked Questions (FAQs) About ICICI Bank Education Loans

🔹 Q1. What is the maximum loan amount offered by ICICI Bank for education?

A:

🔹 Q2. Is collateral required for all ICICI education loans?

A:

No. ICICI Bank offers collateral-free loans:

Collateral is typically required for loan amounts above ₹1 crore or for students not attending approved institutions.

🔹 Q3. What expenses are covered under ICICI’s education loan schemes?

A:

ICICI Bank’s education loans cover the entire cost of education, including:

🔹 Q4. What is the repayment structure of ICICI education loans?

A:

🔹 Q5. Is there a tax benefit on the interest paid for education loans?

A:

Yes. Under Section 80E of the Income Tax Act, borrowers can claim deduction on the interest paid for up to 8 years or until full repayment, whichever comes first. There is no upper limit on the claimable amount.

🔹 Q6. Can I get a loan before getting an admission offer?

A:

Yes, ICICI Bank offers pre-approved and in-principle sanctions, especially for students applying abroad. This can help during the visa process or to show proof of funds for admission.

🔹 Q7. How do I apply for an ICICI education loan?

A:

You can apply through:

Submit your details, upload documents (admission letter, KYC, income proof), and track the application digitally.

🔹 Q8. Who can be a co-applicant?

A:

A co-applicant is mandatory for all education loans. Eligible co-applicants include:

The co-applicant’s income and credit profile are considered in sanctioning the loan.

🔹 Q9. Can NRIs or international students apply for ICICI Bank education loans?

A:

Currently, ICICI Bank loans are offered to Indian residents pursuing education in India or abroad. NRIs may be accepted as co-applicants, but not as primary borrowers.

🔹 Q10. Are there any prepayment penalties?

A:

No. ICICI Bank does not charge prepayment or foreclosure penalties on education loans, allowing you to repay early without extra costs.

✅ Conclusion

ICICI Bank’s education loan offerings are ideal for students looking for a fast, high-value, and flexible financing option for studies in India and abroad. With minimal paperwork, digital convenience, and high eligibility thresholds, ICICI is a top choice among private lenders.

🔗 Apply today at https://shikshavahini.com/apply-for-loan and take the first step toward your academic future—without financial stress!